Online briefing for the Global Advisory CounciI – in conversation with Sir Ronald Cohen

To watch the conversation with Sir Ronald Cohen please click here.

A unique feature of the Impact Ireland fund is the Global Advisory Council, comprised of our investors, the mission of which is to increase awareness of Impact Investing. A key part of our philosophy at VentureWave Capital is to deepen our knowledge of the philosophy and practical implications of Impact Investing.

On 13th October 2021, we were delighted that Sir Ronald Cohen was able to make himself available for a private online briefing with the Global Advisory Council. We were joined by over 30 members of the Council from Europe, the US and Asia.

Sir Ronald Cohen is acknowledged as one of the pioneers and thought leaders of the Impact Investing movement. Sir Ronald speaks about us experiencing an investment revolution, which will be equal in its implications to the Technology and Industrial Revolution.

The discussion was opened by Enda Kenny, Chairman of the Global Advisory Council and former Taoiseach. Enda introduced Sir Ronald as the ‘Father’ of Impact Investing and European venture capital.

(Image: Sir Ronald Cohen and Kieran McLoughlin)

To watch the conversation with Sir Ronald Cohen please click here or the image above.

Kieran McLoughlin, Managing Partner of VentureWave Capital began the interview with Sir Ronald by asking him to recount his experience of his journey to the UK as an Egyptian refugee at the age of 11. Driven and determined, Sir Ronald described how he assiduously sought to rise to the challenge of becoming top of his class in his new school and gained a place in Oxford University. He observed that his experience as a refugee was ultimately “one of challenge but also one of fulfilment.”

Sir Ronald co-founded global private equity firm Apax Partners in 1972, at a pivotal time for the venture capital industry. This was felt when he arrived in Harvard in 1967, when it was anticipated that advances in technology would revolutionise investing. Sir Ronald believed that under the new model of venture capital, it would be small-scale entrepreneurs behind technological development, which shaped his decision to become a venture capitalist.

Broadening vision – From success to significance

Sir Ronald came to the realisation that despite economic growth, the gap between rich and poor was expanding. He left Apax in 2005, turning his focus to tackling social problems and how they could be solved by investment. Government spending was not achieving its desired objectives, and there was a need for financial innovation to connect the vast investment markets with those who wanted to improve the lives of others.

To this point, Kieran noted Bono’s remark that ‘capitalism is not immoral, it is amoral.’ The market, through its discipline, its demand for results, and its capacity can lead to social change.

An Investment Revolution

Sir Ronald set out three main forces that are acting today to improve the world. The first is that of a massive change in values among people, who are no longer interested in buying products causing environmental harm. This practice has been noticed by investors, who are channeling $40 trillion in ESG investments to achieve impact as well as profit.

Secondly, the ongoing powerful leaps in technology are thought to be greater than those of the microchip, including Artificial Intelligence, machine learning, augmented reality and computing. These advances enable us to deliver impact globally in ways that humans could not have done before.

Thirdly, the transparency of Impact standards of companies is now imperative. We can now measure in monetary terms the impact that companies create through their operations, employment and products on the environment. Sir Ronald gave the example of the Harvard Business School Impact Weighted Accounts Initiative to illustrate the monetisation of Impact for companies:

“Taking 3000 companies and measuring environmental impact in dollar terms: 450 companies create more damage in a year than they create profit and 1000 of these companies create damage equivalent to one quarter or more of their annual profit. Together, they create $4 trillion of damage in a single year. Most importantly as investors, a correlation has already emerged between companies that pollute more, and lower stock market valuations.”

Ensuring regulation stimulates innovation

Sir Ronald explained that the shift to impact transparency has become ‘inevitable.’ Research has shown that Impact data can be price sensitive, which has been bolstered by pressure from the EU, the SEC and IOSCO (the International Organization of Securities Commissions) on regulators to introduce legislation on impact reporting transparency.

Sir Ronald argues that “transparency is not something that companies can easily fight today. It is viewed as a human right in a way and is a very important element in democracy.”

Sir Ronald has put forward the case for Impact Investing as an investor himself. He puts this down to a reduction in the risk of taxation and regulation, such as increased carbon taxes or regulation of the use of fossil fuels. He also ascribes this to the superior returns generated due to a higher efficient investment frontage by optimised risk return and increased opportunity sets.

Despite his optimism, Sir Ronald observed how a large barricade remains in the way regarding Impact transparency and integrity. He likens this to the period during the 1930s following the Wall Street Crash of 1929, when the Roosevelt administration established Generally Accepted Accounting Principles for all companies irrespective of size and sector. He believes that we are at a similar crossroads today regarding impact transparency. Victory is in sight, because Impact data is now affecting financial markets and company valuations. In turn, this will force regulators to step in and provide mandatory Impact accounting transparency across all sectors, rather than qualitative reporting.

The event then went into private session for Questions and Answers with the Council members.

To watch the full interview with Sir Ronald Cohen please click here.

About Sir Ronald Cohen

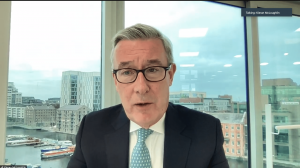

Sir Ronald Cohen is a pioneering philanthropist, venture capitalist, private equity investor, and social innovator. He is recognized as the father of impact investment and European venture capital, and is driving forward the global Impact Revolution. He serves as Chairman of the Global Steering Group for Impact Investment, the Impact-Weighted Accounts Initiative at Harvard Business School, and The Portland Trust. He is a co-founder and former Executive Chairman of Apax Partners Worldwide, a global private equity firm. He is also a co-founder of Social Finance UK, USA, and Israel, co-founder Chair of Bridges Fund Management and former co-founding Chair of Big Society Capital. Oxford and Harvard educated, Ronnie was born in Egypt and left as a refugee at the age of 11, when his family came to the UK. He is now based in Tel Aviv, London and New York. He is the author of IMPACT: Reshaping capitalism to drive real change, which was published in 2020 by Penguin Random House and is a Wall Street Journal Best Seller.

Online briefing for the Global Advisory CounciI – in conversation with Sir Ronald Cohen

To watch the conversation with Sir Ronald Cohen please click here.

A unique feature of the Impact Ireland fund is the Global Advisory Council, comprised of our investors, the mission of which is to increase awareness of Impact Investing. A key part of our philosophy at VentureWave Capital is to deepen our knowledge of the philosophy and practical implications of Impact Investing.

On 13th October 2021, we were delighted that Sir Ronald Cohen was able to make himself available for a private online briefing with the Global Advisory Council. We were joined by over 30 members of the Council from Europe, the US and Asia.

Sir Ronald Cohen is acknowledged as one of the pioneers and thought leaders of the Impact Investing movement. Sir Ronald speaks about us experiencing an investment revolution, which will be equal in its implications to the Technology and Industrial Revolution.

The discussion was opened by Enda Kenny, Chairman of the Global Advisory Council and former Taoiseach. Enda introduced Sir Ronald as the ‘Father’ of Impact Investing and European venture capital.

(Image: Sir Ronald Cohen and Kieran McLoughlin)

To watch the conversation with Sir Ronald Cohen please click here or the image above.

Kieran McLoughlin, Managing Partner of VentureWave Capital began the interview with Sir Ronald by asking him to recount his experience of his journey to the UK as an Egyptian refugee at the age of 11. Driven and determined, Sir Ronald described how he assiduously sought to rise to the challenge of becoming top of his class in his new school and gained a place in Oxford University. He observed that his experience as a refugee was ultimately “one of challenge but also one of fulfilment.”

Sir Ronald co-founded global private equity firm Apax Partners in 1972, at a pivotal time for the venture capital industry. This was felt when he arrived in Harvard in 1967, when it was anticipated that advances in technology would revolutionise investing. Sir Ronald believed that under the new model of venture capital, it would be small-scale entrepreneurs behind technological development, which shaped his decision to become a venture capitalist.

Broadening vision – From success to significance

Sir Ronald came to the realisation that despite economic growth, the gap between rich and poor was expanding. He left Apax in 2005, turning his focus to tackling social problems and how they could be solved by investment. Government spending was not achieving its desired objectives, and there was a need for financial innovation to connect the vast investment markets with those who wanted to improve the lives of others.

To this point, Kieran noted Bono’s remark that ‘capitalism is not immoral, it is amoral.’ The market, through its discipline, its demand for results, and its capacity can lead to social change.

An Investment Revolution

Sir Ronald set out three main forces that are acting today to improve the world. The first is that of a massive change in values among people, who are no longer interested in buying products causing environmental harm. This practice has been noticed by investors, who are channeling $40 trillion in ESG investments to achieve impact as well as profit.

Secondly, the ongoing powerful leaps in technology are thought to be greater than those of the microchip, including Artificial Intelligence, machine learning, augmented reality and computing. These advances enable us to deliver impact globally in ways that humans could not have done before.

Thirdly, the transparency of Impact standards of companies is now imperative. We can now measure in monetary terms the impact that companies create through their operations, employment and products on the environment. Sir Ronald gave the example of the Harvard Business School Impact Weighted Accounts Initiative to illustrate the monetisation of Impact for companies:

“Taking 3000 companies and measuring environmental impact in dollar terms: 450 companies create more damage in a year than they create profit and 1000 of these companies create damage equivalent to one quarter or more of their annual profit. Together, they create $4 trillion of damage in a single year. Most importantly as investors, a correlation has already emerged between companies that pollute more, and lower stock market valuations.”

Ensuring regulation stimulates innovation

Sir Ronald explained that the shift to impact transparency has become ‘inevitable.’ Research has shown that Impact data can be price sensitive, which has been bolstered by pressure from the EU, the SEC and IOSCO (the International Organization of Securities Commissions) on regulators to introduce legislation on impact reporting transparency.

Sir Ronald argues that “transparency is not something that companies can easily fight today. It is viewed as a human right in a way and is a very important element in democracy.”

Sir Ronald has put forward the case for Impact Investing as an investor himself. He puts this down to a reduction in the risk of taxation and regulation, such as increased carbon taxes or regulation of the use of fossil fuels. He also ascribes this to the superior returns generated due to a higher efficient investment frontage by optimised risk return and increased opportunity sets.

Despite his optimism, Sir Ronald observed how a large barricade remains in the way regarding Impact transparency and integrity. He likens this to the period during the 1930s following the Wall Street Crash of 1929, when the Roosevelt administration established Generally Accepted Accounting Principles for all companies irrespective of size and sector. He believes that we are at a similar crossroads today regarding impact transparency. Victory is in sight, because Impact data is now affecting financial markets and company valuations. In turn, this will force regulators to step in and provide mandatory Impact accounting transparency across all sectors, rather than qualitative reporting.

The event then went into private session for Questions and Answers with the Council members.

To watch the full interview with Sir Ronald Cohen please click here.

About Sir Ronald Cohen

Sir Ronald Cohen is a pioneering philanthropist, venture capitalist, private equity investor, and social innovator. He is recognized as the father of impact investment and European venture capital, and is driving forward the global Impact Revolution. He serves as Chairman of the Global Steering Group for Impact Investment, the Impact-Weighted Accounts Initiative at Harvard Business School, and The Portland Trust. He is a co-founder and former Executive Chairman of Apax Partners Worldwide, a global private equity firm. He is also a co-founder of Social Finance UK, USA, and Israel, co-founder Chair of Bridges Fund Management and former co-founding Chair of Big Society Capital. Oxford and Harvard educated, Ronnie was born in Egypt and left as a refugee at the age of 11, when his family came to the UK. He is now based in Tel Aviv, London and New York. He is the author of IMPACT: Reshaping capitalism to drive real change, which was published in 2020 by Penguin Random House and is a Wall Street Journal Best Seller.